Trend Report Incline Village Real Estate 2020-2025

Trend Report for Incline Village Real Estate Market 2020–2025

The Incline Village and Crystal Bay real estate market has undergone a remarkable evolution over the past six years. From the unprecedented surge of the pandemic years to today’s more balanced yet supply-constrained environment, the data tells a clear story: this is a market defined by scarcity, resilience, and long-term value.

Below is a breakdown of key market trends across single-family homes, PUDs, condominiums, and vacant land from 2020 through 2025.

Sales Activity: From Frenzy to Stability

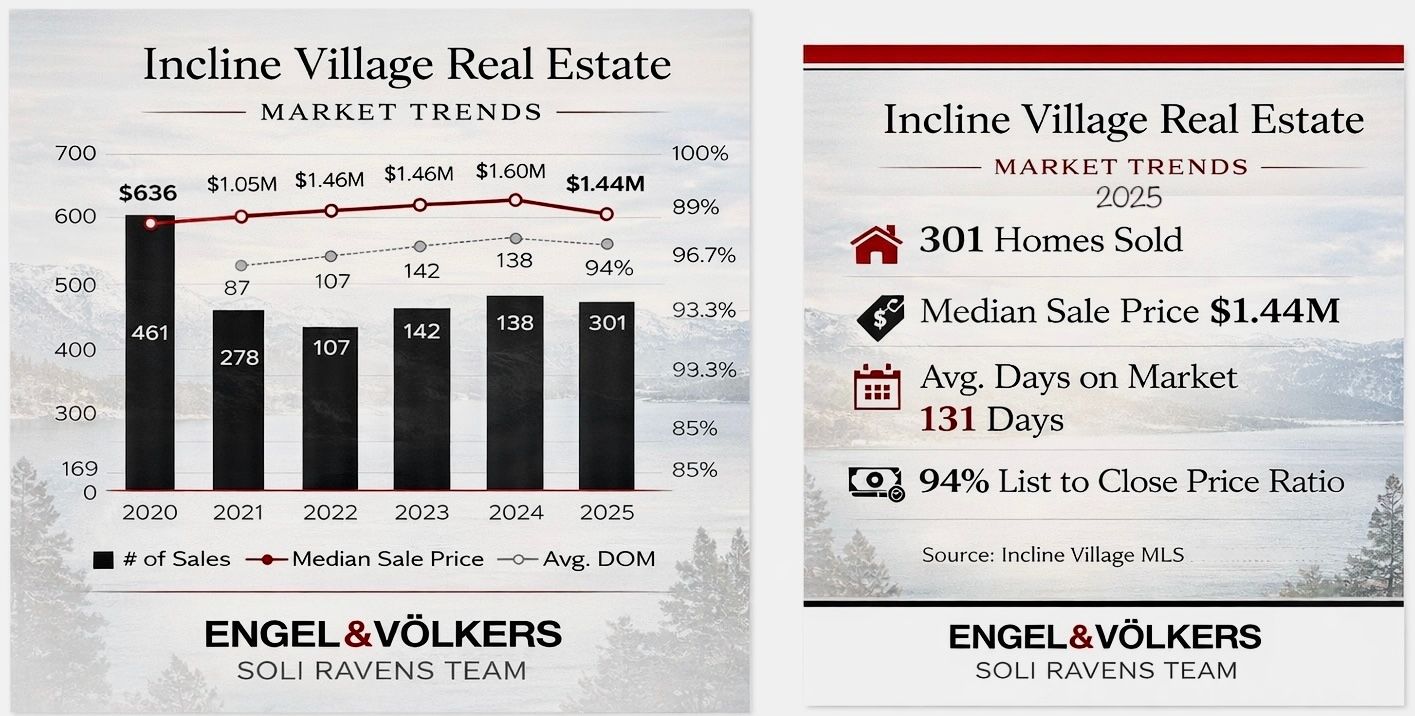

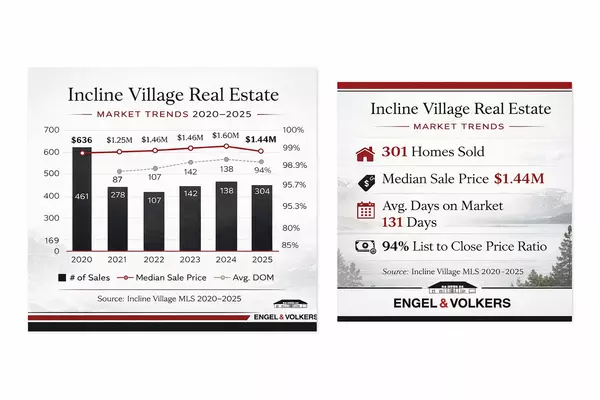

Transaction volume peaked in 2020 with 636 total sales, driven by historically low interest rates and a nationwide flight to lifestyle destinations like Lake Tahoe. That pace slowed significantly over the following years, reaching a low of 249 sales in 2023 as interest rates rose and affordability tightened.

By 2025, total sales rebounded modestly to 301 transactions, signaling a more normalized market—one that prioritizes intentional buyers and sellers over speculative activity.

Pricing Trends: A New Baseline Has Been Established

Despite fluctuations in sales volume, prices have remained remarkably resilient.

-

The median sale price climbed from $1,075,000 in 2020 to a peak of $1,600,000 in 2024

-

In 2025, the median adjusted slightly to $1,440,000, reflecting stabilization; not decline

-

Average sale prices remain elevated, consistently above $2.3M in recent years

This confirms what many local buyers and sellers already know: Incline Village pricing has reset permanently higher, supported by limited inventory and enduring demand.

Luxury Market: A Consistent Driver

One of the most striking trends is the strength of the luxury segment.

-

Highest recorded sale jumped from $27.5M in 2020 to a record $62M in 2024

-

In 2025, luxury activity remained strong with a top sale of $42M

High-end transactions continue to anchor overall market confidence, influencing pricing expectations across all segments.

Days on Market: Still Intentional, Not Immediate

Average days on market shortened dramatically during peak pandemic conditions; dropping to 87 days in 2021, before lengthening again as conditions normalized.

-

2023–2025 DOM hovered between 131–142 days

-

Homes are selling—but not without preparation, pricing strategy, and patience

This reinforces the importance of expert positioning and realistic pricing, particularly as buyers become more discerning.

Negotiation Trends: Buyers Gaining Slight Leverage

List-price-to-close ratios tell a compelling story about negotiation power:

-

100% ratio in 2021 reflected intense bidding competition

-

Ratios moderated to 93–95% from 2023–2025

-

2025 settled at 94%, indicating room for strategic negotiation

The market remains strong but not overheated, creating opportunities for well-qualified buyers and well-advised sellers alike.

What This Means Heading Into 2026

The data confirms that Incline Village and Crystal Bay are no longer driven by short-term cycles. Instead, the market reflects long-term commitment, limited supply, and lifestyle-driven demand.

Key Takeaways Moving Forward:

-

Entry-level inventory remains extremely limited

-

Luxury buyers continue to set market benchmarks

-

Pricing is stable, not speculative

-

Strategy matters more than speed

For buyers, preparation and decisiveness remain essential. For sellers, thoughtful pricing and presentation are key to maximizing value in a discerning market.

Based on data from the Incline Village Board of REALTORS® MLS.. All data sourced from the Incline Village Board of REALTORS® MLS, covering 2020–2025 sales across single-family homes, PUDs, condominiums, and vacant land. Deemed reliable but not guaranteed!

#InclineVillageRealEstate #LakeTahoeRealEstate #SoliRealEstate #SoliRavensTeam #EVRealEstate #GestaltGroup

Categories

Recent Posts

Sandy Ravens

Private Office Advisor / License Partner / Broker | License ID: CA 02120074 | NV BS.145530